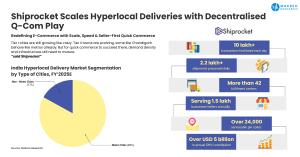

India Hyperlocal Delivery Market Surges With INR 546 AOV, Q-Com and Dark Stores Drive Tier-II/III Last-Mile Logistics

India’s hyperlocal delivery market is transforming with Q-commerce, dark stores, kirana partnerships, and AI-led logistics; set to triple by 2028.

India’s quick commerce market recorded a gross order value of INR 64,000 crore in FY 2025, projected to triple to INR 2 lakh crore by FY 2028.”

MUMBAI, MAHARASHTRA, INDIA, August 24, 2025 /EINPresswire.com/ -- India’s hyperlocal delivery industry is undergoing a pivotal transformation, moving from fragmented small-scale operators to a consolidated, technology-driven network that is reshaping last-mile logistics across the country. According to Makreo Research, the market recorded an average order value (AOV) of INR 546.25 in FY 2024, supported by a strong Compound Annual Growth Rate (CAGR) of 51.84% over the past five years.— Ruchika Rana

The adoption of dark stores, expansion of micro-fulfilment centers, AI-driven route optimization, and closer integration between online and offline retail are accelerating this shift. As major players scale operations across metros and Tier-II cities, India’s hyperlocal delivery ecosystem is establishing new benchmarks for speed, efficiency, and consumer engagement.

Quick Commerce Driving Last-Mile Delivery Growth -

Between 2024 and 2025, India’s hyperlocal delivery market entered a rapid growth cycle, with quick commerce (Q-commerce) emerging as the fastest-growing segment. Makreo Research forecasts that the India Q-commerce market will expand by 75–85% in 2025, driven by rising demand for groceries and daily essentials delivered within 10–15 minutes.

Global and domestic e-commerce leaders are scaling rapidly to meet growing demand. Amazon India deployed 10,000 electric vehicles across 500+ cities by late 2024 and piloted Amazon Now grocery delivery in Delhi, offering 10-minute fulfilment and competing with established Q-commerce platforms.

Flipkart Minutes, the company’s dedicated quick commerce arm, attracted 50 million unique visitors in its first year, with traffic doubling every two months. Leveraging its presence in Tier-II and Tier-III cities, Flipkart is scaling dark store operations and extending last-mile reach into regions with complex infrastructure and workforce challenges.

Retail Partnerships and Dark Store Expansion -

India’s quick commerce sector is evolving through two distinct sourcing models, dark stores and kirana partnerships:

• Swiggy Instamart grew its dark store network from 705 in Q3 FY25 to 1,021 in Q4 FY25.

• Blinkit maintained market leadership with 1,301 dark stores.

• Zepto surpassed 750 micro-fulfilment centers by March 2025.

• Amazon India’s hybrid sourcing model combines dark stores with kirana delivery networks.

• JioMart leveraged 6,000+ kirana partnerships through WhatsApp-enabled sub-hour deliveries, especially in Tier-II and Tier-III cities.

This dual strategy balances control and flexibility. Dark stores offer consistent inventory, faster fulfilment, and broader SKUs but require high capital investment. Kirana partnerships extend reach in underserved markets but face stock variability and inconsistent customer experience.

FMCG Partnerships and Kirana Digital Transformation -

Quick commerce has also reshaped FMCG distribution strategies. Leading companies such as ITC, Tata, Dabur, Nestlé, and Parle are strengthening their partnerships with digital-first kirana models, offering better supply terms and loyalty programs.

Technology platforms like Kiko Live are accelerating digital adoption among kirana stores, enabling cash-on-delivery, ONDC storefronts, and SaaS-based solutions. Participating stores report up to 30% revenue uplift and improved order reliability, reflecting the growing role of kirana digitalization in the hyperlocal ecosystem.

Investments, M & A Strengthening India’s Hyperlocal Delivery Market -

Delhivery - Ecom Express Acquisition: In June 2025, the Competition Commission of India (CCI) approved Delhivery’s acquisition of a 99.4% stake in Ecom Express for INR 1,407 crore (USD 170 million), enhancing its e-commerce delivery capabilities.

Swiggy’s Investment in Scootsy: In February 2025, Swiggy invested INR 1,000 crore (USD 115 million) in its supply chain arm Scootsy, aimed at expanding warehousing and last-mile logistics capacity.

Key Challenges in India’s Hyperlocal Delivery Market -

Despite rapid growth, the industry faces several structural challenges:

• High Cash Burn and Margin Pressure – Quick-commerce players spend INR 1,300–1,500 crore monthly to fund expansion and discounts; Blinkit’s adjusted EBITDA losses rose from INR 103 crore to INR 178 crore in Q4 FY25 despite doubling revenue.

• Regulatory Scrutiny – The CCI is investigating leading players for predatory pricing, while hygiene and transparency concerns in dark stores have led to stricter audits and walk-in requirements.

• Workforce Challenges – Delivery agents face safety, insurance, and compensation issues, with many using personal vehicles not registered for commercial use, leaving them at risk in accidents.

• Operational Failures – Zomato’s closure of “Zomato Instant” highlighted challenges in scaling ultra-fast deliveries while maintaining service quality.

What Lies Ahead for India’s Hyperlocal Delivery Market?

Despite challenges, opportunities remain strong:

• Explosive Demand: Gross order value for quick commerce stood at INR 64,000 crore in FY 2025, projected to triple to INR 2 lakh crore by FY 2028.

• Growing Grocery Share: Q-commerce already contributes 40–50% of online grocery spend in India (2024).

• Rising Digital Penetration: India had 806 million internet users in early 2025, with Tier-II/III users growing fastest.

• Tier-II and III Growth: These cities contributed 56% of e-commerce shoppers in FY 2024, forecast to reach 64% by FY 2030.

• Improved Economics: Tier-II cities require 800 orders/day to breakeven, compared to 1,300 in Tier-I cities, making smaller cities financially viable expansion hubs.

India’s hyperlocal delivery market is evolving into a technology-driven ecosystem where dark stores, kirana partnerships, and AI-led logistics are reshaping last-mile fulfilment. Despite margin pressures, regulatory oversight, and workforce challenges, the sector stands to benefit from strong consumer adoption, FMCG collaborations, and growth in Tier-II cities.

As India’s digital retail expands, hyperlocal delivery is becoming the fulfilment backbone of the e-commerce economy. For a detailed industry outlook, see Makreo Research’s India Hyperlocal Delivery Market Size and Forecast (FY 2021–FY 2030).

About Makreo Research

Makreo Research and Consulting is a global market research firm delivering fact-based insights and tailored consulting services. Specializing in hyperlocal, logistics, retail, and consumer markets, we conduct on-ground surveys across Tier I, II, and III cities, map consumer perceptions, and analyze regional demand dynamics that influence buying behavior. Our expertise includes location assessments for dark stores and micro-fulfillment centers, helping businesses identify growth pockets and optimize last-mile operations. By combining domain knowledge with rigorous research practices, Makreo Research empowers clients to make confident, market-aligned decisions. Our commitment to experience, expertise, authoritativeness, and trustworthiness ensures every insight serves as a reliable guide in evolving market landscapes.

Related Reports:

Indonesia Dark Kitchen and Fulfillment Center Market

For tailored research or specific market inquiries, Please contact us via email or our website.

Meetu Bhasin

Makreo Research and Consulting

+91 96196 99069

sales@makreo.com

Visit us on social media:

LinkedIn

X

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.